This page catches up the most recent headline developments in the Greek economic crisis. For a more complete backstory, click on the site search for ‘Greece’.

September 21, 2015 – Weary Greeks vote for more of the same

After a record low turnout in Greece’s snap election clearly returned Prime Minister Alexis Tsipras and his Syriza party to power, nothing much has, really, changed.

As Amanda Dardanis at Mashable wonders: Is the country that invented drama now fed up with it?

On the line on Sunday: very little indeed. After months of hardship, Greece has already reluctantly accepted a bailout that would slash the country’s budget and reduce everything from retirement pensions to schools to farming to social services. Those who voted for the Syriza party — which promised the cuts would never happen — have before already realized their dream has failed and their principles won’t be upheld again.

http://twitter.com/tsipras_eu/status/645691361753063424

Mark Whitehouse at Bloomberg reports on one “glimmer of hope” for the Greek economy.

Data from the Greek central bank — which records a liability for every euro that leaves the country’s banking system — suggest that the end of the standoff has at least brought a bit of relief. During the year through June, during which the left-leaning Syriza came to power and clashed with European creditors, outflows amounted to more than 77 billion euros, equivalent to more than 40 percent of Greece’s annual economic output. In July and August, after a bailout deal was reached, the flow reversed: About 6 billion euros came back in.

***

August 20, 2015 – Syriza split sets up snap election

Greeks will go to the polls next month after Prime Minister Alexis Tsipras resigned and called a snap election amid division and likely split within his governing Syriza party over austerity measures and the country’s EU bailout agreement.

***

August 12, 2015

As the Greek parliament prepares to vote on Thursday on the terms of the latest bailout agreement, Reuters reports on details of the “stress test” required by the country’s creditors.

***

August 11, 2015

After a marathon negotiating session, Greece appeared to have agreed a broad rescue package with its creditors, but, as the FT reports, concerns remain. The Athens parliament is set to vote on the package beginning on Thursday.

***

August 7, 2015

The migrant crisis in Greece is worsening, as more people arrived in the EU via its shores in July than in the whole of 2014.

***

August 2, 2015

Stock markets in Greece are set to reopen on Monday after five weeks, with warnings of an immediate hit for share prices.

***

July 26, 2015

As Greece prepares to re-start talks on Monday with its creditors over bailout terms, reports surfaced of contingency plans for a return to the Drachma which, Reuters reports, served to highlight the chaos within the ruling Syriza party.

***

July 22, 2015

The Greek parliament voted to approve a second tranche of reform measures tied to a potential bailout by the country’s creditors. Prime Minister Alexis Tsipras was successful in restraining a rebellion by members of his Syriza party. Reuters reports:

The legislation easily passed with the backing of 230 votes in the 300-seat chamber, once again due to opposition support.

But 36 Syriza deputies – or almost a quarter of the party’s 149 lawmakers – voted against the overall bill or abstained, though significantly for Tsipras that was a smaller rebellion than the 39 deputies who defied him in last week’s vote.

***

July 21, 2015

The Greek parliament will vote on Wednesday on a second round of domestic reforms necessary to facilitate the bailout talks.

***

July 19, 2015

Banks across Greece are to re-open on Monday, as “the first cautious sign of a return to normal after a deal to start talks on a new package of bailout reforms” Reuters reports. The Athens Stock Exchange will remain closed and some capital controls on money transfers will still be in place.

***

July 17, 2015 – Greece in flames as Germany votes to approve bailout

The German parliament voted in favor of continuing the process towards a third bailout for Greece. But a significant number of lawmakers in Chancellor Angela Merkel’s party bloc voted against – more than double the number who had voted against the second bailout in February. Not much of a 61st birthday gift, but the Chancellor got her way in the end.

According to German finance minister Wolfgang Schäuble, the New York Times‘ Paul Krugman “has no idea about the architecture and foundation of the European currency union.” Read the full interview at Spiegel here.

Former IMF executive Ashoka Mody has an interesting potential solution to the dilemma of preserving the single currency.

“A German return to the deutsche mark would cause the value of the euro to fall immediately, giving countries in Europe’s periphery a much-needed boost in competitiveness.

“The disruption from a German exit would be minor. Because a deutsche mark would buy more goods and services in Europe (and in the rest of the world) than a euro does today, the Germans would become richer in one stroke.

Meanwhile, Greek Prime Minister Alexis Tsipras reshuffled his cabinet to get rid of hardline leftists opposed to further austerity measures. But, The Guardian reports, “the limited nature of the reshuffle reinforced mounting speculation that elections would almost certainly be held in the early autumn.”

As if making some kind of allegorical visual point, most of the country was in flames as firefighters tackled some 50 blazes it was suspected may have been lit as part of anti-austerity protests.

***

July 16, 2015

The German parliament gets its chance on Friday to vote on whether to proceed with the agreed €86billion bailout for Greece.

On Thursday, the European Central Bank increased the emergency liquidity support for Athens, and it was announced that Greek banks would re-open on Monday.

If you haven’t already – and if you must – you can read the Euro Summit agreement on Greece annotated by former finance minister Yanis Varoufakis on his blog. An example:

Given the need to rebuild trust with Greece, the Euro Summit welcomes the commitments of the Greek authorities to legislate without delay a first set of measures [i.e. Greece must subject itself to fiscal waterboarding, even before any financing is offered].

***

July 15 2015 – Riots as Greek parliament backs bailout

The Greek parliament overwhelmingly approved a tough package of austerity measures required as a condition of a third Eurozone bailout. But there were riots on the streets of Athens as the proposals were debated. Prime Minister Alexis Tsipras saw more than 30 of his own MPs vote against him in the late-night session, but won the vote by 229-64.

Eurozone finance ministers will hold a conference call on Thursday morning to discuss next steps. Then, the European Central Bank will meet to discuss how to prevent Greece’s banks – which have been closed for two weeks – from collapsing.

***

July 14 2015 – Greece set for bailout vote as IMF warns on debt relief

Greece heads for a crunch parliamentary vote on Wednesday as the deadline approaches for acceptance of sweeping austerity measures ahead of a European bailout.

Prime Minister Alexis Tsipras, who has been trying to unite a fractured country – and his own party – behind the deal reached at the weekend, warned that the country’s banks could remain closed for a month, before any bailout could take effect.

* Follow developments at The Guardian‘s live blog here.

* CNBC‘s Squawk Box live blog is here.

Reuters reports, meanwhile, that the IMF has thrown something of a spanner in the works by warning that Greece will need much greater debt relief than its creditors have previously contemplated.

The IMF study, first reported by Reuters, said European countries would have to give Greece a 30-year grace period on servicing all its European debt, including new loans, and a dramatic maturity extension. Or else they must make annual transfers to the Greek budget or accept “deep upfront haircuts” on existing loans.

The Debt Sustainability Analysis is likely to sharpen fierce debate in Germany about whether to lend Greece more money. The debt analysis also raised questions over future IMF involvement in the bailout and will be seen by many in Greece as a vindication of the government’s plea for sweeping debt relief. A Greek newspaper called the report, which was initially leaked, a slap in the face for Berlin.

The New Statesman, meanwhile, has the first interview with former Greek finance minister Yanis Varoufakis since his resignation.

***

July 13, 2015

Greek Prime Minister Alexis Tsipras continues his efforts to win domestic support for the proposed €86 billion ($96 billion) bailout deal and its associated austerity measures.

The Guardian writes:

Tsipras, locked in fraught negotiations with EU leaders in Brussels until Monday morning, indicated that he would carry the Athens parliament, despite some defections, in a vote on the package by Wednesday.

Determined to keep his party together ahead of an expected onslaught by MPs opposing the outlined deal, Tsipras summoned his closest allies to a meeting in Athens before a gathering of his parliamentary party on Tuesday.

***

UPDATE, 4PM ET, 13 July

Greek Prime Minister Alexis Tsipras has begun the tricky task of attempting to win domestic support for unpopular austerity measures by Wednesday to help secure a third bailout by creditors, after a marathon overnight meeting ended in a “deal” that would keep Greece in the European Union.

As Reuters reports,

..he must pass legislation to cut pensions, increase value added tax, clamp down on collective bargaining agreements and put in place quasi-automatic spending constraints. In addition, he must set 50 billion euros of public sector assets aside to be sold off under the supervision of foreign lenders and get the whole package through parliament by Wednesday.

So perhaps understandably, he faces something of a revolt, not least from within his own party.

MIDNIGHT ET, 12 July – ‘In Greek talks, trust is another commodity in short supply’

An emergency summit of Eurozone leaders is still meeting in Brussels in the early hours of Monday, in a bid to find some resolution to the quagmire that is the Greek financial crisis, and agree some immediate practical next steps.

German chancellor Angela Merkel said that “the situation is extremely difficult if you consider the economic situation in Greece and the worsening in the last few months, but what has been lost also in terms of trust and reliability.” The Washington Post writes that “this echoes what a lot of other Europeans are saying – that Greece simply cannot be trusted to deliver on its end of any deal.” But the lack of trust goes both ways.

Athens has been told its government must pass a series of sweeping austerity measures by Wednesday for discussions to begin on a possible bailout. But as the Wall Street Journal reports, supporters of Prime Minister Alexis Tsipras are “struggling to understand how the new deal on the table is tougher than the one they rejected.”

http://twitter.com/EconBizFin/status/620380246303461377

Amid talk of a “humiliation” of Greece, details had spread of the creditor demands, including a €50bn transfer of Greek state assets, required ahead of discussions over a new loan. The hashtag #ThisIsACoup was quickly trending on Twitter.

Paul Krugman writes at the New York Times that the Eurogroup’s demands constitute “pure vindictiveness”.

It is, presumably, meant to be an offer Greece can’t accept; but even so, it’s a grotesque betrayal of everything the European project was supposed to stand for.

John Cassidy writes at the New Yorker on Germany’s “indecent proposal” and the claims of former Greek finance minister Yanis Varoufakis that his German counterpart, Wolfgang Schäuble, isn’t interested in a deal to keep Greece in the Eurozone.

Dirk Kurbjuweit, in an editorial in Spiegel writes that, with so much at stake, it’s time for “realpolitik” and “small steps.”

This means that Germany must display forbearance. Germans have been forgiven for so much in their own history that they should also be capable of forgiving others. Despite mistakes made by the Greeks, solidarity remains the correct course. That’s not to suggest that the Tsipras administration can ignore the treaties Greece has with the EU. Nor should there be a debt haircut, because Spain and Portugal would demand equal treatment and that would place an unbearable strain on the euro zone. However, deferments and interest rate discounts are possible. No one should be too proud to talk about the possibility of concessions.

* Follow live updates at The Guardian here.

* Follow live updates at the BBC here.

* Follow live updates from CNBC here.

* Follow live updates from Politico here.

Meanwhile, CNN reported that Russia was preparing to throw Greece an “energy lifeline.”

Again, here are some explanations of why what’s happening, and how it gets resolved, is important:

***

July 9, 2015 – The ‘final’ countdown

In true pomp-rock end-times fashion, if you Google “final countdown” and “Europe” you – of course – get this…

But over the next couple of days we’ll see if the expectations of cataclysm for Greece, the Euro and the European project in general prompted by Sunday’s deadline actually come to pass.

http://twitter.com/Rwoods101/status/619146650519498752

http://twitter.com/dominicru/status/619146198608420864

Here are a couple of places to follow along as the story unfolds:

* The Guardian‘s live blog is here

***

July 7, 2015 – Amid EU urgency, Greece has another ‘final’ deadline

Greece’s European creditors admitted the “stark reality” of the economic crisis in that country, setting out what they say is a “final” timetable for Athens to offer reforms “in return for loans that will keep the country from crashing out of Europe’s currency bloc and into economic ruin,” Reuters reports.

Athens was told it has to present concrete reform proposals on Wednesday as part of a formal loan request, with further details to be provided and finalized on Thursday and Friday. If these proposals are approved – or indeed if they aren’t – a meeting of EU leaders this Sunday will determine Greece’s fate.

The Guardian writes:

The Greek leadership exasperated EU leaders by failing to present new bailout proposals on Tuesday. It is to present a formal application on Wednesday for a new rescue package from the European Stability Mechanism (ESM), the eurozone’s permanent bailout fund. If Berlin, Paris, Brussels and other key creditor capitals can agree the terms and timings with Athens, Greece would be offered a stay of execution in the euro. Sunday’s summit would then be of the 19 eurozone leaders.

If not, the summit of all 28 leaders, including David Cameron and heads of government of other non-euro countries, would instead convene to deal with the consequences of a Greece cut loose from the eurozone financial system.

***

July 6, 2015

Ahead of Tuesday’s Eurozone summit, and with its financial state becoming “increasingly dire,” Greece was told to come up with “serious proposals in order to restart financial aid talks, a day after Greeks voted overwhelmingly to reject more austerity,” Reuters reports.

Athens extended capital controls and said its banks would stay closed through Wednesday, while Prime Minister Alexis Tsipras is expected to present a new plan in Brussels on Tuesday, but the AP reports

..the situation was complicated by the European Central Bank’s refusal late Monday to increase assistance for Greek banks desperately needing cash and facing imminent collapse unless a rescue deal is reached.

Earlier on Monday, Finance Minister Yanis Varoufakis quit and rode off into the sunset.

HSBC’s Chief Global Economist Stephen King writes at the FT that, whatever happens at Tuesday’s summit and beyond, the key question is who picks up the bill?

If a deal is not immediately forthcoming, a lot will depend on the stability or otherwise of a Greek economy facing a self-imposed blockade thanks to capital controls and bank holidays. The risk is that Greece runs out of euros, forcing the introduction of a new currency that might initially be called simply an IOU but might eventually become known as a “new drachma”.

The introduction of a new currency, alongside the euro, could prove hugely problematic – with obvious risks of hyperinflation – but, if handled with restraint, might allow liquidity to flow to a degree consistent with stabilisation of Greek output. That stabilisation, in turn, might allow the government to deliver structural reforms consistent with an eventual return to the euro, with all sins forgiven.

Yet the terms of any subsequent return to the euro fold would be controversial.

And, waiting in the wings, there’s always…

http://twitter.com/PutinRF_Eng/status/618111109292236800

***

July 5, 2015 – European leaders stunned by Greece’s resounding ‘no’

Europe’s political and economic leaders are scrambling for their next steps after Greece voted overwhelmingly to reject a rescue package from the country’s creditors.

With virtually all the votes counted, Greeks voted roughly 61%-38% against the bailout and associated austerity measures. But what they were voting for – and exactly what happens next – remains unclear.

German Chancellor Angela Merkel and French President Francois Hollande will meet in Paris on Monday to discuss a response to the vote and how best to preserve the continent’s single currency. An extraordinary EU summit has been called for Tuesday. The European Central Bank will also meet on Monday, as Greece’s banks remain closed.

Greek Prime Minister Alexis Tsipras had called for a ‘no’ vote to give him greater leverage in what he hopes will be further negotiations for a better deal from creditors.

http://twitter.com/tsipras_eu/status/617796515071926272

But as the Wall Street Journal reports, the only certainty now is uncertainty, a feeling reflected as Asian markets opened.

Wolfgang Munchau writes in the FT on why the ‘yes’ campaign failed.

Contempt for democracy and economic illiteracy are not merely tactical errors. Those two “qualities” are now the remaining ideological planks of what is left of the European project. Greece is a reminder that the European monetary union, as it is constructed, is fundamentally unsustainable. This means it will need to be fixed, or it will end at some point.

(Tomorrow’s Papers Today)

4PM ET : Early signs point to heavy ‘no’ vote in Greece

Initial indications from Greece’s referendum show a significant majority against the Eurozone debt bailout plan. With about two-thirds of ballot papers counted, the vote was running around 60-40 for the ‘no’ camp.

https://twitter.com/tsipras_eu/status/617625490694795264

Developing

***

June 3, 2015 – Crisis-torn Greece divided as referendum looms

Greece heads into Sunday’s crucial referendum – a last-minute challenge to the legality of the vote was rejected on Friday and it will go ahead – on a knife-edge, as both sides make their final pitches to their fellow citizens, many of whom say they are still undecided, according to latest polls.

Reuters reports that Prime Minister Alexis Tsipras is framing the ballot “as a battle for democracy, freedom and European values.”

..The 40-year-old left-wing leader told Greeks to “turn your backs on those who terrorize you daily”.

“On Sunday, we are not just deciding that we are staying in Europe, but that we are deciding to live with dignity in Europe,” he told the crowd of at least 50,000.

Here’s 18 key facts on the situation, via the Washington Post, while Vox has 12 charts and maps that explain the Greek crisis, including one that shows the country’s debt-to-GDP ratio is “an insane 172%”.

In a Reuters exclusive, “Eurozone countries tried in vain to stop the IMF publishing a gloomy analysis of Greece’s debt burden which the leftist government says vindicates its call to voters to reject bailout terms, sources familiar with the situation said on Friday.”

Also, according to Reuters, the Financial Times reported that Greek banks were preparing contingency plans for a possible “haircut” on deposits amid fears of financial collapse, but the country’s banking association said the report was “completely baseless”.

Meanwhile the FT‘s Martin Wolf runs down the options facing the Greek people, saying

One does not put an overweight patient on a starvation diet just after a heart attack. Greece needs growth. Indeed, the economic collapse explains why its public debt has exploded relative to GDP. The programme should have eliminated further austerity until growth was established, focused on growth-promoting reforms, and promised debt relief on completion.

Here’s the latest dispatch from the streets via Vice News.

***

July 2, 2015

As Greece prepares for its referendum on Sunday over whether to accept the Eurozone creditors’ bailout plan, the Wall Street Journal reports that the IMF had “raised the stakes” by warning that

Greece’s economic situation has considerably worsened thanks to the escalating conflict with its creditors, and any new rescue deal that involves the IMF would require greater financial generosity from Europe than eurozone leaders have been willing to countenance so far.

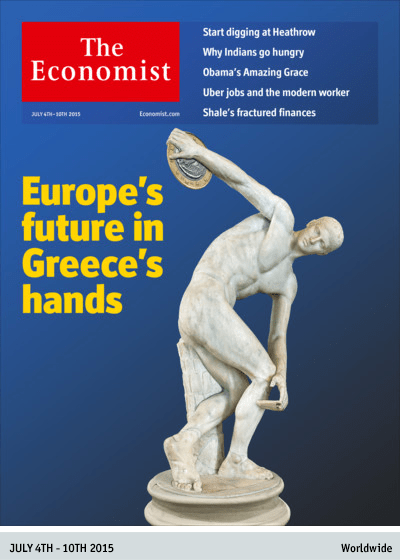

The Economist writes in its latest issue that however the current crisis resolves itself, Europe will be changed for ever.

Look beyond Greece, and the threat of further conflict within the euro is all but inevitable. Although Greece’s departure would prove the euro is not irrevocable, nobody would know what rule-breaking would lead to expulsion. Nor would it resolve the inevitable polarisation of debtor and creditor governments in bail-outs. If the single currency does not face up to the need for reform, then this crisis or the next will witness more Greeces, more blunders and more dismal weeks. In time, that will wreck the euro and the EU itself.

***

June 30, 2015 – Crisis for Eurozone as Greece misses $1.7bn payment to IMF

Despite a last-minute appeal to its creditors for a two-year package of financial aid, Greece at midnight on Tuesday became the “the first developed economy to default on a loan with the International Monetary Fund,” Reuters reports.

* Follow developments on The Guardian’s live-blog here.

The other nations currently in IMF default are Somalia, Sudan and Zimbabwe. Greece on Tuesday set a record for the size of a missed payment ($1.7billion).

What happens now? And what are the prospects for the Eurozone and for Greece itself?

Kathy Gilsinan writes at The Atlantic’s live-blog that

In the “slow exit” option, Greece’s creditors don’t demand their deposits back immediately, but if Greece fails to secure outside sources of financing as public bills such as pensions and state salaries come due, “Greece could substitute ‘IOU’s’ for euros in some of its payments,” per CNBC. In the short term, these would in effect become a parallel currency. As the Wall Street Journal explained, “Over time, euros would disappear from circulation because people would hoard them as a store of value—and people would spend the government IOUs. De facto, the drachma, whether or not it would so be called, would become the main means of exchange.”

But there’s also the “no exit” option, where the country just keeps the euro. Polls have indicated that this is what Greeks want to do, and it’s what Prime Minister Alex Tsipras promised to do. If, say, he manages to secure a post-default bailout deal in negotiations set for tomorrow—allowing it to pay its debts to the IMF a few hours, or a few days late—Greece stays in the Eurozone that much longer. But the course of negotiations so far doesn’t give much reason for hope.

http://twitter.com/msgbi/status/616041393094574080

Ahead of Sunday’s referendum, a Royal Bank of Scotland infographic runs through the options for the immediate future.

But, predictably, there are always those predicting jam tomorrow…

Meanwhile, an IndieGoGo fundraiser for the country went offline after being swamped with curious visitors. Gizmodo reports that before crashing it had raised “a shocking €407,715.”

***

June 28, 2015 – Greece shuts banks as financial meltdown looms

Banks and the stock exchange in Greece will be closed on Monday and possibly for the next six days until a planned national referendum, as the government in Athens tries to “check the growing strains on its crippled financial system,” Reuters reports.

Asian markets slid early on Monday amid fears of broader harm to the Eurozone and the global financial system should the country fail to meet its due loan payment to the IMF on Tuesday.

The Washington Post reports:

Sunday’s decision to declare a bank holiday was a signal that Greece’s five-year battle to stay in the shared euro currency may swiftly be coming to an end. ATMs in Athens were running out of money, and tensions were running high as Greeks stood in line for hours to scrape together cash for basic supplies. Lines mounted at gas stations as worried residents topped off their tanks for what could be a period of time in a cashless nation.

The Greek Prime Minister Alexis Tsipras made a national televised address and sought to reassure audiences at home and abroad.

(Greek with English subtitles)

http://twitter.com/tsipras_eu/status/615221564951429125

***

June 21, 2015 – Greece teeters amid 11th-hour debt proposals

Amid anti-austerity protests in Athens and continuing withdrawals from Greek banks, the EU said it welcomed new proposals from Prime Minister Alexis Tsipras as a “good basis for progress” ahead of the crucial emergency summit on Monday to address the nation’s debt crisis. Reuters reports:

Tsipras will meet European Commission President Juncker, ECB President Mario Draghi, IMF head Christine Lagarde and euro zone finance ministers chairman Jeroen Dijsselbloem at 11 a.m. (5:00 a.m. ET), an EU spokeswoman said. Euro zone finance ministers are due to meet 90 minutes later and a summit of euro zone prime ministers and presidents is scheduled at 7 p.m. (1:00 p.m. ET).

Nevertheless, global markets remain “extremely nervous” ahead of whatever happens next. Meanwhile, there is plenty of pessimism that, even if a deal is agreed on Monday, the longer-term damage has already been done.

Maria Margaronis writes at The Nation that the crisis “isn’t quite as dire as the media often portray it, but is still a dangerous moment for Greek democracy and for Europe.”

As it becomes clear that the two halves of Syriza’s mandate—to stay in the eurozone and end austerity—are incompatible, the cleavages in Greek society open wider. The pressure to choose between the two things most Greeks want is splitting the country more or less along class lines: those who have suffered most from the crisis and who want an end to austerity above all, against those who want to stay with the euro at any price. The split is easily exploited by the old political elites who’ve lost their foothold on power, who hate Syriza with a vengeance and who (like the creditors) will stop at almost nothing to destroy it.

***

June 19, 2015

European negotiators are set to work through the weekend after German Chancellor Angela Merkel said there “must be a deal” between Greece and its creditors ahead of Monday’s emergency EU summit. Meanwhile, investors withdrew 1.2billion Euros from Greek banks on Friday alone.

http://twitter.com/benschott/status/612026603099541504

***

June 17, 2015

A meeting of Eurozone finance ministers in Luxembourg on Thursday will address the growing Greek debt crisis, but as the BBC reports, the Athens government thinks “an immediate solution unlikely.”

“Failure to reach an agreement would… mark the beginning of a painful course that would lead initially to a Greek default and ultimately to the country’s exit from the euro area and, most likely, from the European Union,” [the Bank of Greece] said in a report.

***

June 15, 2015

The Greek government and its creditors appeared to harden their positions amid a further impasse over debt talks, and warnings of the aftermath of a default.

Gideon Rachman at the Financial Times looks at ‘Four games the Greeks may be playing.”

The uncertainty about what is driving Athens is only amplified because a parallel set of questions can be asked about the motivations of Brussels and Berlin. It could equally well be argued that the German government is bluffing, in the expectation of Greek capitulation; or that the team around Chancellor Angela Merkel has miscalculated in expecting the Greeks to “behave reasonably”; or that the German government, like its Greek counterpart, is trapped by domestic politics; or, finally, that there are many in Germany, particularly in the finance ministry, who now actively want to force Greece out of the euro.

***

June 11, 2015

The International Monetary Fund stopped negotiating with the Greek government over its debt situation, Reuters reports, as the EU “told Greek Prime Minister Alexis Tsipras to stop gambling with his cash-strapped country’s future and take the crucial decisions needed to avert a devastating default.”

***

June 10, 2015

As European leaders agreed to intensify moves to resolve Greece’s debt crisis ahead of the next deadline at the end of this month, S&P cut the Athens government’s credit rating for the third time in a year, signaling that a default may actually be moving closer.